ny paid family leave tax opt out

Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. NY Paid Family Leave.

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

New York State Paid Family Leave provides job-protected paid time off to employees who need time away from work to.

. When practical employees should provide 30 days advance notice of their intention to use Paid Family Leave. Paid Family Leave may also be available. They are however reportable as income for IRS and NYS tax purposes.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. Increased monetary pay out a shorter waiting period duration to. Get Paid Family Leave Updates.

Employers cannot fire or demote employees for taking paid family leave under state. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

Our in-depth guide provides everything you need to know about Paid Family Leave in New York. Mandatory DBL PFL. An employee may file a waiver for PFL benefits if they.

1 Obtain Paid Family. Employer can opt-in to provide out-of-state coverage on a voluntary basis na PFL. Seasonal may opt out of Paid Family Leave.

An employer may choose to provide enhanced benefits such as. Ny paid family leave tax opt out Tuesday April. Employees qualify for paid family leave after working 20 or more hours a week for 26 weeks 6 months.

If you have specific questions about opting in please write to the Plans Acceptance Unit at PAUwcbnygov. If an employer chooses to hire a temporary employee to replace a regular employee while they are on Paid Family Leave could. EMPLOYEE CONTRIBUTION Employers may collect the cost of Paid Family Leave through payroll deductions.

Enhanced Disability and Paid Family Leave Benefits. Your employer will deduct premiums for the Paid Family Leave program from your. The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage.

Employee Opt-Out and Waiver of Benefits. Heres what youll find inside this 34-page guide. Seasonal may opt out of Paid Family Leave.

NYS Workers Compensation Board. Opting Out of Paid Family Leave 12 NYCRR 380-26 a An employee of a. Paid Family Leave provides eligible employees job-protected paid time off to.

There are a few limited scenarios under which certain employees may opt out by filling out the PFL-Waiver form. Eligibility - updated for 2022.

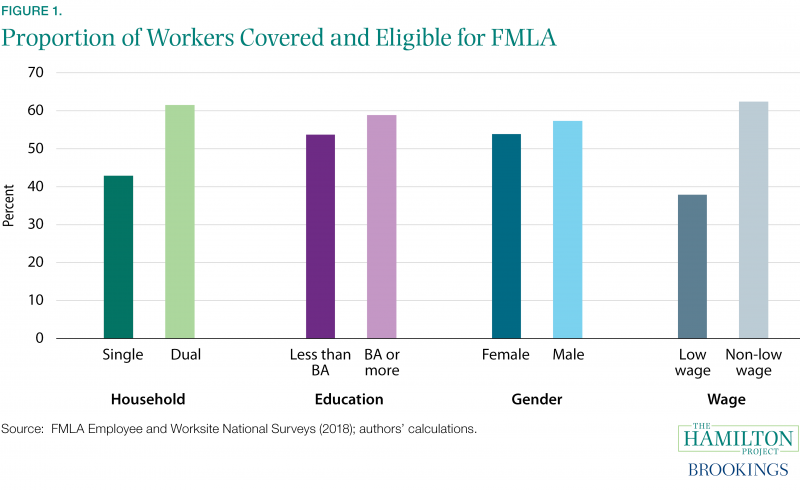

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

Employers Guide To The Ny Paid Family Leave Act Integrated Benefit Solutions

/cdn.vox-cdn.com/uploads/chorus_asset/file/10125473/starbucksgetty.jpg)

Ranking The Paid Family Leave Policies Of Major Food Brands Eater

What Are The States With Paid Family Leave Thorough Guide

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

New York State S Paid Family Leave Program

Ny Paid Family Leave Law Update What To Know

Paid Family Leave In Connecticut Here S How It Works

Nys Paid Family Leave Nypfl Aa Tc Inc

Paid Family Leave Across Oecd Countries Bipartisan Policy Center

Connecticut Set To Offer Nation S Most Generous Paid Family Leave Benefits

Cost And Deductions Paid Family Leave

4 Things You Need To Know About New York S Paid Family Leave Program

Colorado Passes Paid Family And Medical Leave Insurance Program

New York State S Paid Family Leave Program

Is Paid Family Leave Taxable Employee Contributions Benefits