irs unemployment tax refund status tracker

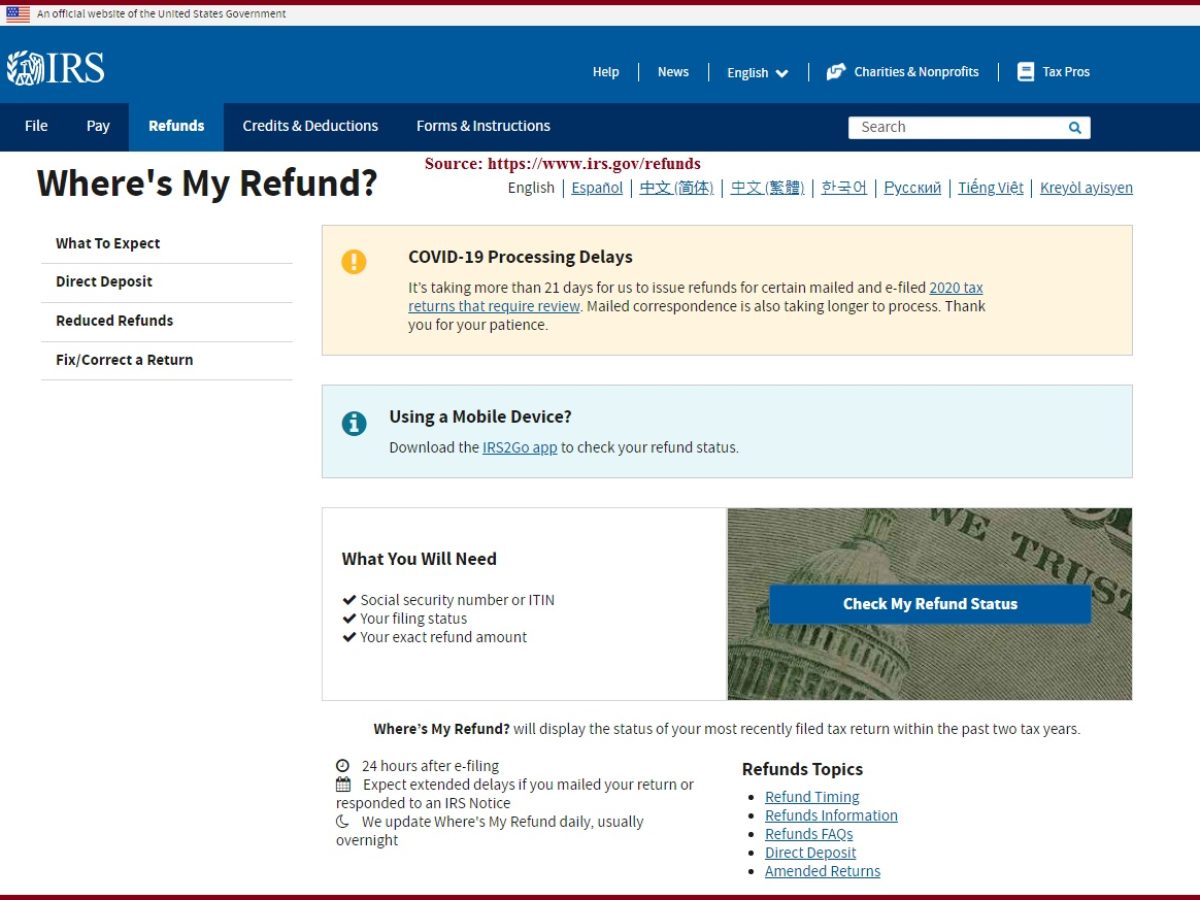

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Using the IRS Wheres My Refund tool.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Your Social Security numbers.

. The IRS has sent 87 million unemployment compensation refunds so far. Ways to check your status. Choose the federal tax.

How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million. Your exact whole dollar refund amount. Irs unemployment tax refund How to track the status of your tax refund onlineWatch Our Other VideosThe IRS Is Massively Late Sending Millions of Tax Refunds.

To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. Viewing your IRS account. The first refunds are expected to be issued in May and will continue into the summer.

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional. IRS unemployment refund update. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Check For The Latest Updates And Resources Throughout The Tax Season. Unemployment Refund Tracker Unemployment Insurance TaxUni.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. TAX SEASON 2021. There is no tool to track it but you can check your tax transcript with your online account through the IRS.

Check your refund online does not require a login Sign up for Georgia Tax Center GTC account. Call the DOR automated telephone line at 877-423-6711 to check the status of your tax refund. Irs unemployment tax refund status tracker.

All you need is internet access and this information. You wont be able to track the progress of your refund through the. GTC provides online access and can send notifications such as.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. You can start checking on the status. Your Social Security number or Individual.

The state will ask you to enter your Social Security number or ITIN and the exact amount of your expected refund in whole dollars. The letters go out within 30 days of a correction. Press option 2 Individual Income Tax Information then option 2 to inquire about the.

Said it would begin processing the simpler returns first or those eligible for. You can find this by signing in to TurboTax.

You Have One Last Chance To Get A Surprise Tax Refund This Year The Irs Says

The Irs Has Sent Nearly 58 Million Refunds Here S The Average Payment

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Your Tax Return Is Still Being Processed Irs Where S My Refund 2022

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refund Timeline Here S When To Expect Yours

How To Find Your Irs Tax Refund Status H R Block Newsroom

Millions Of Taxpayers Getting Surprise Bills Revised Tax Statements From Irs Irs Taxes Tax Irs

Tax Refund Timeline Here S When To Expect Yours

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Tax Refund Status Update R Irs

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

Irs Releases Draft Form 1040 Here S What S New For 2020 Irs Forms Tax Return Income Tax Return